Dave Burt, CEO of DeltaTerra Capital and renowned “Big Short” investor who foresaw the 2008 housing crisis, has voiced his concern over a potential repeat of the crisis. His worry is centered on what he sees as an underestimation of the systemic risk flooding poses to the mortgage market.

Burt’s successful prediction of the subprime mortgage crisis and his consequent financial gains while at New York’s Cornwall Capital were documented in Michael Lewis’s bestseller, The Big Short. This work of nonfiction highlighted the events leading to the 2008 economic meltdown.

Years after the 2008 crisis, Burt asserts that the mortgage market is disregarding the risk flooding presents, which could potentially catalyze another housing market crash. DeltaTerra’s studies indicate that 20 percent of U.S. homes have significant exposure to a pricing discrepancy due to flood risks. This discrepancy could devalue the housing market by up to $200 billion from its 2022 valuation of $45.3 trillion.

Burt explained to CNBC, “We think of this repricing issue as maybe a quarter of the size and magnitude of the [global financial crisis] in aggregate, but of course very, very damaging within those exposed communities.” He suggests that if lenders fail to acknowledge the potential consequences of flood risks, a 2008-esque price adjustment may be imminent.

Homes devastated by floods dramatically depreciate, exposing mortgage borrowers to the risk of loan default. Burt elaborated, “Ultimately, until people have good information about what these climate-related costs are going to look like, we’re creating new problems every day. I think that’s really the crux of the matter.”

Burt has previously expressed his concerns about looming flood risks. He said, “I’m always on the lookout for these big systemic issues, and there’s a few reasons for that … If something is mispriced, then as an investor, your main opportunity to add value is to identify something that is either too cheap to purchase for your clients or something that it is too expensive to sell for your client.” He identified single-family homes as the most vulnerable properties in floods, which are the most frequent natural disaster in the United States.

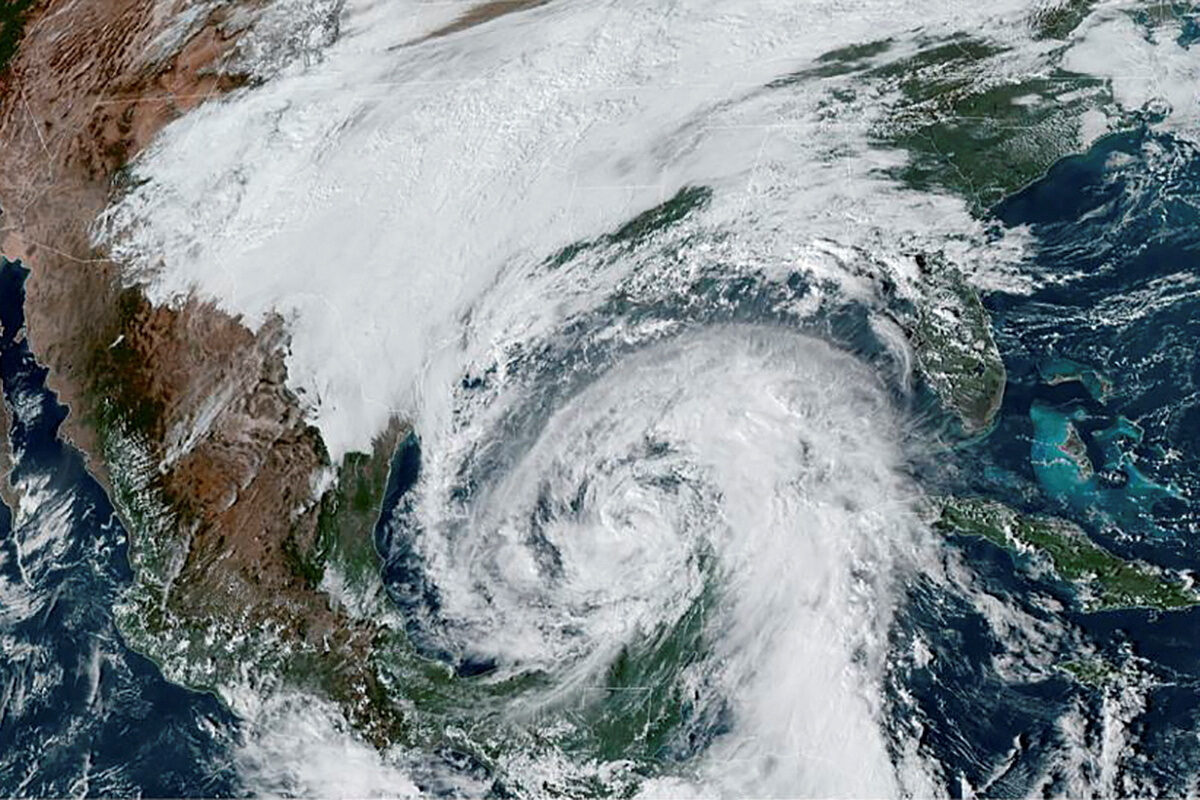

Last September, for example, Hurricane Ian inflicted over $100 billion in damage, making it the third costliest hurricane in U.S. history, according to the National Oceanic and Atmospheric Administration (NOAA). The hurricane exposed deficiencies in Florida homeowners’ flood insurance as many battled for compensation checks insufficient to cover their homes’ damage, rendering them uninhabitable.

Burt reiterated the importance of factoring in the cost of home maintenance, including potential flood damage, when buying a home. His comments align with a period of month-to-month volatility in home sales. April saw a 13-month high in new U.S. single-family home sales. Last month, new home sales rose 4.1 percent to a seasonally adjusted rate of 683,000 units, the highest since March 2022, as reported by the Department of Commerce. This increase was largely due to a chronic shortage of previously owned homes on the market.

However, this month’s sales pace was revised lower to 656,000 units, mirroring rates similar to those in January 2018, pre-pandemic. New home sales are considered a leading indicator of the housing market’s health, and they are known to fluctuate on a month-to-month basis. The National Association of Realtors reported last week that roughly half the country is experiencing rising home prices, multiple offers, and homes selling above list price.