Top investors at the annual Milken conference have warned of more economic pain to come after the collapse of First Republic Bank.

Attendees at the conference said that the third seizure of a U.S. regional bank by the Federal Deposit Insurance Corporation (FDIC) since March is threatening to constrain credit and accelerate the path toward a severe economic slowdown.

The May 1 takeover of First Republic by federal regulators and the immediate sale of the bank to JPMorgan proceeded as investors and financiers arrived for the Milken Institute Global Conference, in Beverly Hills, California, for one of the largest financial conferences in the world.

Most of the California lender’s remaining $93.5 billion in deposits were sold along with its assets to JPMorgan after rivals PNC, and Citizens, made a failed bid.

The nation’s largest bank, which would ordinarily be barred from acquiring another lender since it controls more than 10 percent of all U.S. deposits, had regulations waved by the government.

JPMorgan estimated the deal would add roughly $500 million in annual income to its earnings.

People pass a sign for JPMorgan Chase at it’s headquarters in Manhattan in this file photo. (Spencer Platt/Getty Images)

New Regulations Will Hurt Ability To Lend

The failure of First Republic did not cause the same amount of panic as the collapse of Silicon Valley Bank and Signature Bank in March, despite a sell-off in some bank shares.

That brought a sigh of relief from financial executives and Biden administration officials.

Still, many prominent investors spoke on the conference’s opening day to warn about the aftereffects of the latest bank failures.

Several argued that banks would now be forced to comply with rules that could restrict their lending ability as the markets feel the increasing strain from the Federal Reserve’s hawkish interest rate policy.

“We’re going to see a real ratcheting-up of regulation in the banking system, particularly on many …. regional lenders,” said David Hunt, CEO of PGIM, who added that impact of the new rules would be “quite constraining.”

“What that will do is … further hinder the supply of credit that’s going into the economy. And I think that we are going to see now a real slowing that begins to happen to aggregate demand.”

Apollo Global Management CEO Marc Rowan told Bloomberg, “so you’re now the CEO of a big regional bank—your costs of funds is up, your regulatory costs are up. Can you lend money?”

Anne Walsh, the Chief Investment Officer for Fixed Income at Guggenheim Partners Investment Management, said, “This means they will lend less.”

Avoiding a Hard Landing

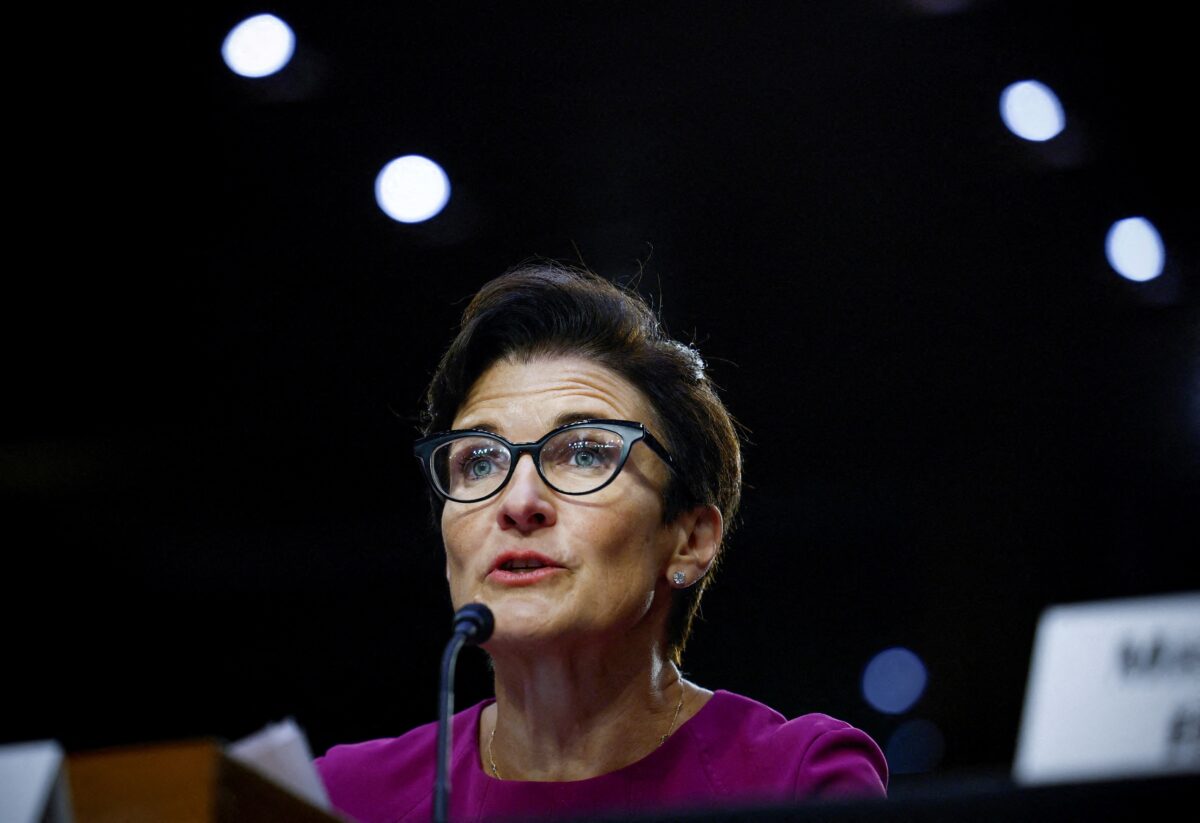

However, others, like Citigroup CEO Jane Fraser, believe that the U.S. financial system remains fundamentally sound and that only a handful of banks were poorly managed.

She said that the latest banking turmoil had demonstrated the overall resilience of the American lending sector.

The $30 billion lifeline to save First Republic by some of the major banks, in an unsuccessful attempt to keep the lender afloat, merely bought it some time, said Fraser.

The CEO was unapologetic, saying, “We were in a position to do it, which everyone should take incredible comfort in.”

Frasier did warn that a significant tightening of credit could be a drag on the U.S. economy but that there is enough pent-up demand to allow it to pull out of a recession rather quickly.

Billionaire investor, Charlie Munger, downplayed the recent problems, telling The Financial Times, that the latest banking crisis was “not nearly as bad as it was in 2008.”

Meanwhile, Kristalina Georgieva, the International Monetary Fund chief, blamed U.S. regulators’ “complacency” for the regional bank failures.

“We know there was unnecessary deregulation … and now we saw the price to pay. We saw supervision has not been up to par.”

Georgieva also called for new regulations to prevent the rapid bank runs caused by depositors’ ability to move money online with a single click.

“It is the speed money can move from one place to another. It goes into the territory of the unthinkable,” she said.

Commercial Real Estate Market

Munger also noted that many domestic banks were “full of bad loans,” thanks to the collapse of commercial property prices, and warned that “trouble happens to banking just like trouble happens everywhere else. In the good times you get into bad habits … When bad times come, they lose too much.”

“A lot of real estate isn’t so good anymore,” Munger said, explaining that “we have a lot of troubled office buildings, a lot of troubled shopping centers, a lot of troubled other properties. There’s a lot of agony out there.”

Rowen agreed with Munger’s assessment, telling Bloomberg that the next wave of turmoil across the financial sector would likely come from the commercial real estate market.

“It’s a bad day to be an office owner in San Francisco and Chicago,” said Rowen, but that the stress on the industry will not be systemic but rather concentrated, leading to losses.

Torsten Slok, an economist at Apollo Global Management, said in March that the regional banks had issued about 70 percent of all outstanding commercial real estate loans.

There are currently about 4,000 regional banks in the United States, with some carrying debts that are potentially toxic.

Katie Koch, the CEO of the bond fund manager TCW, told Bloomberg, that she sees the economy likely heading for a deep recession by the end of the year and is concerned that troubles at regional banks would not just drag down commercial real estate but smaller businesses.

“Small businesses rely on small banks, and that’s a big problem, a very, very big problem,” said Koch, adding that “half of Americans are employed by small businesses,” making those workers vulnerable to a credit crunch.

She added that investors should prepare for “major accidents” in the private credit market in the next 12 to 18 months, saying, “we have had five years where ‘diligent light’ became a term, and that is not going to be fun over the next five years if you arrived at it from that perspective.”

Koch called for investors to put more of their money into “globally systemically important banks” as regional banks face increased risks of deposit flight due to their high exposure to commercial real estate.

Inflation Restricts Fed Policy

Some analysts warned that persistent inflation may curtail Fed policymakers’ room to maneuver in a market downturn. In contrast, others dismissed predictions that the Fed would eventually cut interest rates this year after its final hike of 25 basis points in May.

“That’s a primed-for-disappointment situation,” said Karen Karniol-Tambour, co-Chief Investment Officer at the hedge fund Bridgewater Associates.

She disagrees with those investors who predict that the Fed will cut rates twice before the end of 2023.

“It’s time for the markets to fully digest how constrained central banks are going to be relative to the last 30, 40 years, when every time there was a tiny murmur of a problem, you could just lower rates [and] print money.”