For the first time in two years, high-priced California rentals have undergone a slight decline, while markets in the Midwest are experiencing an increase in monthly rentals.

Realtor.com’s March rental report indicates 14 markets in California have seen year-over-year declines, including Riverside-San Bernardino at -5.3 percent, Sacramento at -2.1 percent, and San Francisco and Los Angeles both at -0.8 percent. Speculation is that the declines may be connected to tech firm layoffs and a general weakening of the job market in the state.

However, even with those declines, California still has some of the highest rents in the country. Average rents in the San Jose-Sunnyvale-Santa Clara area are holding the top spot in the nation, coming in at $3,304 per month. San Diego-Carlsbad, Los Angeles-Long Beach, and San Francisco-Oakland are close seconds with just over $2,800 per month. Only the New York City metro area rivals these monthly rentals at $2,994.

In the more affordable Midwest markets, rentals have been on the rise in markets like Indianapolis at 10.3 percent, Cincinnati at 9.6 percent, and Milwaukee at 7.8 percent. In the Sun Belt markets, where rents rose steadily during the Pandemic, the growth rates are slower at just 0.2 percent.

Monthly rentals are slightly over $1,200 in areas like Indianapolis-Carmel-Anderson, as well as Kansas City and St. Louis. The Detroit-Warren-Dearborn region is slightly higher with a $1,324 monthly average. The only location dipping below $1,000 a month is Oklahoma City, with an average rent of just $993.

“Mirroring trends that we’ve seen in the for-sale market, affordability is shaping housing demand, with lower-cost areas continuing to see stronger rent growth, home price increases, and competitive real estate markets,” said Realtor.com Chief Economist Danielle Hale. “Markets in the Midwest and Northeast are benefiting from this trend while cities in the West are adjusting in the opposite direction.

“The good news for renters is that overall rent prices and price growth have both cooled from their highs in early 2022, offering some relief for cost-burdened consumers who are facing higher prices across the board.”

Nationally, the U.S. rental market experienced single-digit growth for the eighth month in a row. The median rent in the country’s largest metro areas increased to $1,732 per month—up by $15 from last month and down from $32 at the peak of 2022. In January 2022, rents nationwide jumped 16.4 percent and remain 25.7 percent higher than in 2019.

However, even these more affordable rents are still out-of-range for countless Americans.

“The average monthly rent is definitely a struggle for many renters,” Andrew Aurand, senior vice president for Research for the National Low Income Housing Coalition (NLIHC), told The Epoch Times. “They can’t afford anywhere near $1,700 in monthly rent. A family of three, for example, with poverty-level income couldn’t afford more than $620, and many extremely low-income renters can’t afford even that.”

Aurand acknowledged that finding affordable rents will likely remain difficult until adequate federal resources are added into programs that provide that housing. In some areas, renters in crises can call 2-1-1 for referrals to emergency housing programs in their community.

“Unfortunately, nearly every community lacks an adequate supply of housing affordable for renters with low incomes—and many of these renters work, are seniors, or have a disability,” he said. “Currently, the U.S. has a shortage of 7.3 million affordable and available rental homes for low-income renters, and this shortage impacts every state and metropolitan area. It also impacts nearly every rural community.”

The NLIHC has been educating lawmakers about the need for affordable homes and mobilizing its members and supporters to advocate for good policy solutions, including budget increases for successful affordable housing programs.

Aurand said while some rents are stabilizing and actually declining in other locations, low-income individuals and families are still striving to make ends meet. “Rents are still significantly higher now than prior to the pandemic, and low-income renters were struggling long before then,” he added.

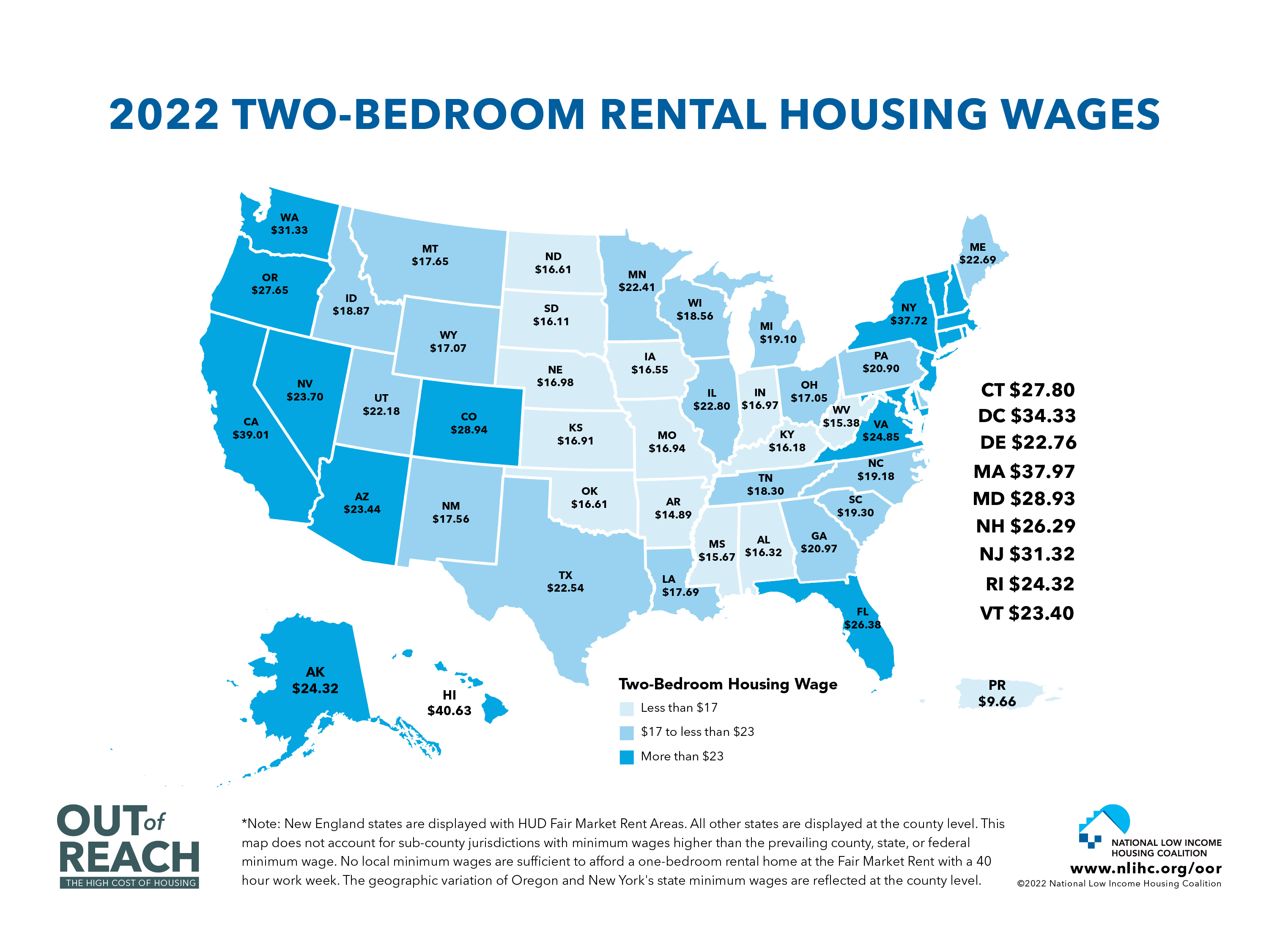

In its annual “Out of Reach” report, the NLLIHC notes that counties or states with less expensive rental housing also tend to have lower wages, so the low housing costs are still unaffordable for low-wage workers in that area.

In California, the nation’s second highest housing wage, an individual or couple would need to earn $39.01 an hour to afford a two-bedroom rental home. They would also have to work about 104 hours a week. New York, with the nation’s fourth highest housing wage, would require an individual or couple together to earn at least $37.72 an hour to afford a two-bedroom rental home.

On the other end, Arkansas holds the lowest housing wage at just $14.89 an hour, required to afford renting a two-bedroom home. At minimum wage, the average individual or couple would need to work a total of 54 hours a week. Oklahoma, Mississippi, Alabama, and Kansas also offer much more affordable options.

“Overall, the U.S. has a shortage of 7.3 million rental homes affordable and available to renters with low incomes,” noted Aurand. These incomes typically are at or below either the federal poverty guideline or 30 percent of their area median income, whichever is greater.

“Only 33 affordable and available rental homes exist for every 100 extremely low-income renter households,” Aurand said.