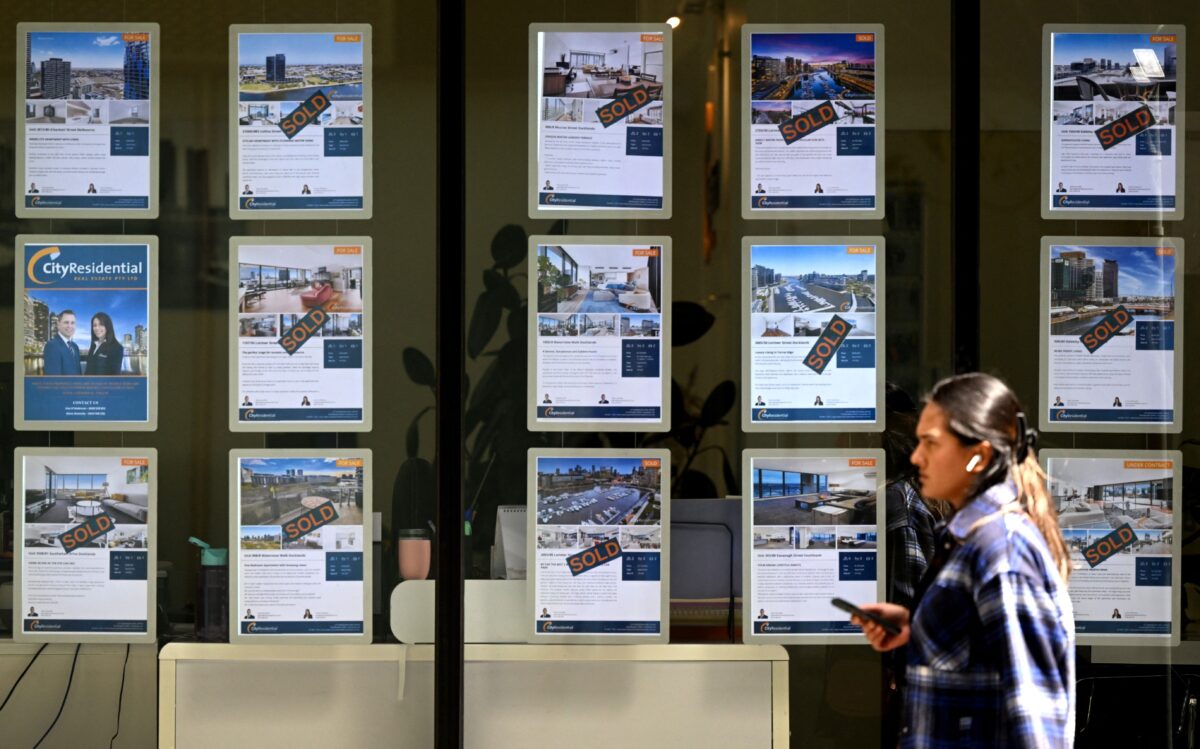

Australia’s residential property market has made a comeback as the national house prices rose for the third consecutive month in May.

According to the real estate data provider CoreLogic, the national home value index climbed by 1.2 percent in May, following increases of 0.5 and 0.6 percent in March and April.

Prior to this, Australian house prices dropped for ten straight months after the Reserve Bank of Australia (RBA) started an interest rate hiking cycle in early May 2022.

While Sydney led the country with a 1.8 percent growth in home values in the month, the city also saw the most significant increase in the premium housing markets.

Since January, Sydney’s median house prices have lifted by 4.8 percent, equivalent to an increase of $48,390 (US$31,600).

Brisbane and Perth recorded growth of 1.4 percent and 1.3 percent, respectively, while house prices in other capital cities grew by less than one percent.

CoreLogic research director Tim Lawless said the upward trend was caused by persistently low housing supply and rising demand.

“Inventory levels are 15.3 percent lower than they were at the same time last year and 24.4 percent below the previous five-year average for this time of year,” he said.

“With such a short supply of available housing stock, buyers are becoming more competitive, and there’s an element of FOMO (fear of missing out) creeping into the market.”

Auction clearance rates also trended up, staying above 70 percent in the past three weeks due to high competition.

Weaker Growth Recorded in Regional Australia

While regional prices also improved during the period, the growth was much lower than in capital cities.

Specifically, the combined regionals index lifted by only 0.5 percent in April after a 0.2 percent and 0.1 percent increase in March and April.

South Australia experienced the highest rise in regional home values at 0.9 percent, followed by Queensland at 0.8 percent and Tasmania at 0.7 percent.

In contrast, Victoria was the only jurisdiction that reported a drop in regional house prices (down 0.5 percent).

“Although advertised housing supply remains tight across regional Australia, demand from net overseas migration is less substantial,” Lawless said, pointing out that only 15 percent of Australia’s net overseas migration came to regional areas each year.

“Additionally, a slowdown in internal migration rates across the regions has helped to ease the demand side pressures on housing.”

It is worth noting that despite the gains in the past three months, house prices in most markets are still below their recent peaks, except for Perth.

New Housing Approvals Plunge to Decade Low

The new home value data comes as new housing approvals across Australia fell to the lowest level in 11 years.

According to the latest Australian Bureau of Statistics data, the total number of dwellings approved across the country dropped 8.1 percent in April to a seasonally adjusted 11,594, following a one percent decrease in March.

While approvals for apartments, townhouses and semi-detached houses plunged by 16.5 percent, the detached house sector reported a 3.6 percent drop in new construction approved.

Tom Devitt, a senior economist at the Housing Industry Association, said the decline in housing approvals was due to economic headwinds, which were set to persist for some time.

“This continues the long-lagged response of Australian homebuyers to the RBA’s interest rate hiking cycle, with further declines expected in the coming months,” he said.

“The combination of construction cost blowouts, labour uncertainties, increased compliance costs and taxes on investors has seen approvals for multi-units fall.”

The economist warned that if dwelling approvals continued to drop, the current rental crisis would exacerbate.

MEDIAN HOUSING VALUE ACROSS CAPITAL CITIES:

Sydney: $1,052,810

Canberra: $825,053

Melbourne: $755,871

Brisbane: $713,939

Hobart: $655,403

Adelaide: $654,767

Perth: $580,023

Darwin: $491,386