Hawaii, California, Massachusetts, Washington and Colorado join list of least affordable states for 2023

A recent survey from Realtor.com and Censuswide finds 78 percent of potential home buyers expect to be priced out of the market if prices and mortgage interest rates continue to increase.

Over 50 percent of that group blames inflation as the number one external factor keeping them from realizing the American dream. Rising interest rates and mounting home prices also ranked high—48 and 46 percent, respectively—in second-guessing their decision to buy.

“Unfortunately, we don’t expect rates to return to the historic lows we saw during the Pandemic. As the economy has changed, so has the mortgage market and it’s not realistic that we’ll see rates return to the 3 percent range,” Hannah Jones, Realtor.com economic data analyst, said in a statement.

“However, it is possible that we’ll see rates return to the low 6’s next year, which could be when we’ll see a lot of buyers jumping back into the market.”

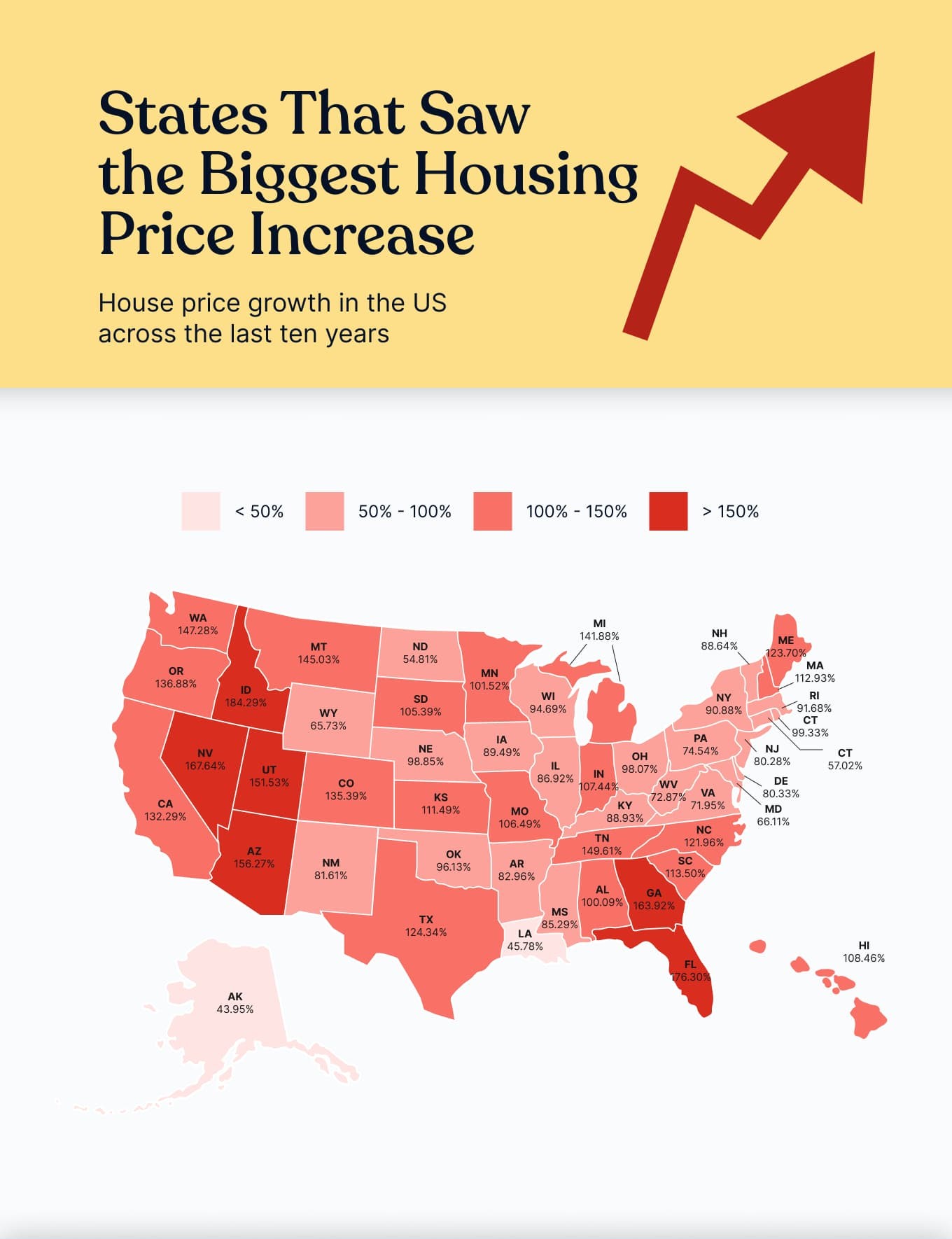

Even states that traditionally offered more affordable home prices are experiencing huge hikes. In a new report by Life and My Finances, a lending firm, states like Idaho, Nevada, Georgia, and Florida saw single-family home prices escalate nearly three times what they were just 10 years ago.

In 2013, the median home price in Idaho was $153,266. Today, that same home would sell for $435,726. Florida’s median home price was just $144,184 in 2013 and now that price has jumped to $398,378.

Derek Sall, founder of Life and My Finances, told The Epoch Times he was very surprised by the survey results.

“It actually shocked me to see places like Idaho and Nevada on that list,” he said. “During the pandemic, there was a larger influx of people from California and Washington to these states, which probably helped to drive the home prices up.”

Arizona and Utah are also on the list of home prices that have soared more than twice the amount in the past 10 years. Arizona enjoyed a median sales price of just $163,345 in 2013, but in 2023, that price rose to $418,605.

“In Arizona, you have places like Sedona, Flagstaff, and Scottsdale that tend to have a lot more luxury housing, so that can also bring up the median listing price for the state as a whole,” added Sall.

Listed as the nation’s least affordable state is Hawaii at the top, with a median single-family home price of $966,277. With a 20 percent down payment of $193,255.40, homeowners would still be saddled with a monthly mortgage payment of about $5,247.18.

Not surprisingly, California was listed as the second least affordable state, with a median home price of $744,023.

Massachusetts came in third with $576,889 as its median home price.

Comparing Hawaii to the Mid-West, Sall’s survey finds that $239,000 would buy a 2,300-square-foot single-family home with three bedrooms and three bathrooms in Michigan, but the same amount would cover only a 400-square-foot, one-bedroom, one-bath home in Hawaii.

Where is Affordable Housing?

Sall’s report indicates West Virginia is the top spot with median single-family home prices of just $146,499. With a 20 percent down payment of $29,299.80, monthly payments for homeowners would be approximately $792.36.

Additional locations—all in the South—are Mississippi, with a median sales price of $161,582, and Arkansas, at $178,264.

Louisiana and Kentucky round up the top five locations with both coming in at under $200,000.

Taking a look at the least expensive cities in the U.S., the survey named several locations in Pennsylvania, including Sunbury, where a single-family home could be purchased for only $63,040, and Pottsville, for $91,000. Four cities in Illinois also made the list, including Sterling, at $84,000, and Carbondale, at $88,750.

Conversely, the most expensive city on the list is San Jose, California, with a median home price of $1.2 million, followed by Santa Cruz at $1.08 million. Rounding out the top five priciest locales are Heber, Utah; Edwards and Breckenridge, Colorado, and San Francisco, California, at $922,000.

Still, Sall believes mortgage rates are likely to come down by the end of the year. “Home prices may still continue to rise, but perhaps more slowly this time,” he suggested. “But I think the biggest problem is that salaries are not keeping up with inflation or listing prices.”

Demand Outpaces Supply

Gay Cororaton, chief economist with the Miami Realtors, acknowledged that higher mortgage interest rates and rising home prices are keeping inventory tight.

“In Florida, demand is definitely outpacing supply, especially in the Miami-Dade area that has seen a 6 percent price growth year-over-year,” she told The Epoch Times.

“You also have homeowners who refinanced during the pandemic, and if they’re paying 3 percent interest now, they don’t want to sell and repurchase with a 6 percent-plus interest rate.”

Local prices, she explained, are relative depending on where buyers are located.

“If someone is moving from New York or California, they may find it more affordable, but if buyers are coming from other areas of the South or the Mid-West, prices will seem higher,” said Cororaton.

Locally, she noted, a third of the people who move out of Miami-Dade relocate to Broward County, which is relatively close. The current median single-family home price in Miami-Dade is $600,000, compared to $575,000 in Broward. Those who purchase condos will likely save much more as the median price of a two-bedroom Miami condo is $415,000 versus just $270,000 for the same size condo in Broward.

As in many other vacation spots throughout the country, Florida buyers often come in with cash deals.

“The good news is that the Fed has paused on interest rate hikes, and with inflation going down, hopefully, we’ll see a more affordable market in 2024,” added Cororaton.

Realtor.com chief economist Danielle Hale noted that all home buyers seem to be faced with mixed emotions when it comes to the current housing market.

While 51 percent said buying a home would be exciting, over 25 percent admitted it would be very stressful, and 15 percent acknowledged it would be financially challenging and nearly impossible.

Hale also agrees that inflation is beginning to slow down.

“It’s possible that we’ve reached the end of the Fed’s tightening cycle, which could mean that mortgage rates have reached their peak, at least in the short-term,” she said. “This would be a welcome relief for buyers who have been feeling like they might be priced out of the market.”