Australia will launch a temporary task force known as a “fusion cell” to combat the growing issue of investment scams.

Led by the competition watchdog, the Australian Competition and Consumer Commission (ACCC), and the financial services regulator, the Australian Securities and Investments Commission (ASIC), the fusion cell will draw experts from both public and private sectors to minimise losses.

These include specialists from banks, the telecommunications industry, and digital platforms.

The first fusion cell will focus on investment scams as Australians lose over $1 billion (US$670 million) annually to fraud. Overall, Australia lost a record $3.1 billion to scams in 2022. This was an 80 percent increase from 2021.

“Investment scams lead to the highest level of reported individual losses and cause emotional devastation for victims,” ACCC Deputy Chair Catriona Lowe said.

“This additional level of co-ordination and focus across government and relevant industries will target investment scam activity more effectively and help prevent further losses to these scams.”

Launching the National Anti-Scams Centre (NASC), Assistant Treasurer Stephen Jones said the fusion cell targeting investment scams will run for an initial six months and publicly report its outcomes.

“There is a scamdemic,” Jones said.

“The top priority of our new National Anti-Scams Centre is to detect and disrupt scammers before they can reach Australians.”

The centre will build capability and data sharing technology to centralise scam report information, then distribute and analyse the obtained information.

“So over the next few months, we’ll be working to put in place tough new codes of practice to ensure that in the area of banks, for example, everybody understands their obligations,” he said at a press conference.

These standards will also apply to social media platforms, which have been identified as the primary channels that scammers use to target Australians.

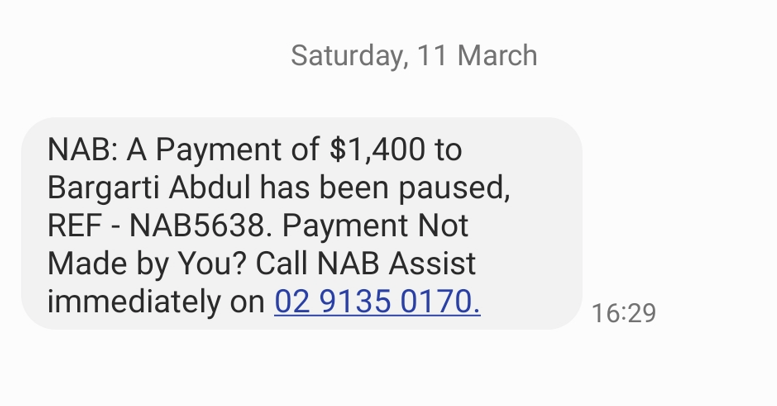

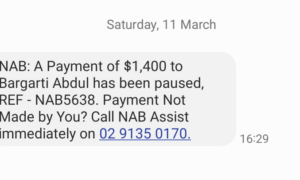

“We’ve got to ensure that platforms are doing their bit to ensure that this dangerous and criminal activity, particularly in the area of investment scams, is being attacked at source,” he said, highlighting that text messages were a major channel.

Jones said the government was currently blocking about nine million scam text messages every six months, a number that he hoped to improve.

“So the work that I’m doing with my colleague [MP] Michelle Rowland to ensure that there is a new SMS registry to ensure that we know and are able to block those damaging SMS messages that are coming through attacking victims,” he said.

“We know that the vast majority of attacks at the moment are coming through SMS messages—those annoying scam messages that are driving Australians nuts.”

This signified that the Albanese government was “taking the fight up” to the scammers.

Big Four Banks Called Out

The Australian Banking Association (ABA) welcomed the launch of the NASC and the banking sector’s participation, calling it a timely reminder to remain vigilant against scams.

“As scammers get increasingly sophisticated and scams more complex, this cross-sector approach highlights that an ecosystem approach to disrupting scams is essential, and all sectors have a key role to play in the continued fight against scams—this includes government, banks, telcos, social media, crypto platforms and individuals,” ABA Deputy CEO Vanessa Beggs said.

It comes after ASIC called for all Australian financial institutions, in particular, the “Big Four”—Commonwealth, Westpac, ANZ, and NAB—to improve their approach to handling scams.

In April, an ASIC analysis revealed that scam losses affected 31,700 major bank customers, losing more than $550 million in the last financial year.

ASIC Deputy Chair Sarah Court said corporate Australia needed to “work cohesively to stop scams at the source.”

The report revealed that collectively, banks detected and stopped 13 percent of scam payments made by their customers.

Meanwhile, it has been revealed that compensation was paid to victims in only two to five percent of incidents, with proactive customers who made a complaint more likely to receive reimbursement.

“We’d like to see the banks take steps to evolve their scam management practices, including how they inform and educate customers and help them through what is a distressing time,” Court said.