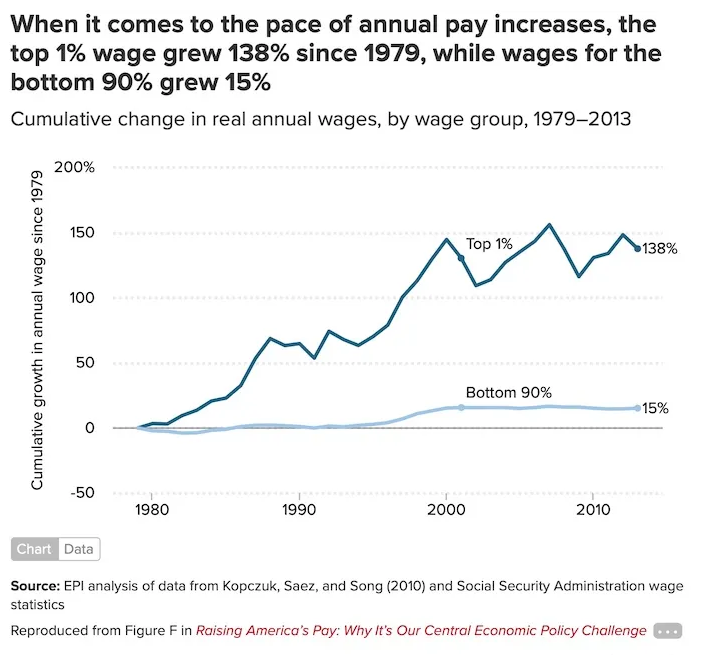

Two stories in today’s news combine to illustrate how bankrupt American thinking is. One is a story about how Americans cannot stop living from paycheck to paycheck because real wages (i.e., adjusted for inflation) for 90% of America have only risen 15% since 1979. Yet, the truth is worse than the story tells: Once you adjust the adjustment for real inflation (i.e., what inflation would have been over all those years if it were still calculated the more honest way it was back in 1979), real wages have gone backward.

In fact, the bottom 10% of wage earners in America have even seen their real wages (as inflation is currently calculated) go backward by 5%. Healthcare benefits have also plummeted for most Americans.

Meanwhile CEO pay at those same corporations that have cut healthcare have soared … as we all know. In 1965 CEOs made a handsome 20 times what the regular workers at their corporation made. They were the fat cats who lived in the big house and drove the big car. As of 2013, however, they made 300 times! (And that was still the bottom of the Great Recession before the past decade of historically outsized stock gains!) CEO pay even grew three times faster than the top 0.1% of wage earners and twice as fast as corporate profits. So, CEO pay raises weren’t even commensurate with whatever they may have brought to corporate profits, and those profits likely grew by cutting the labor costs. (Those numbers are with CEO stock options realized … upon which they also pay lower taxes.)

The other story is about the extreme labor shortage, and it tries to make the argument that we must increase immigration to solve the problem. Yeah, let’s solve the disparity in wages by bringing in more desperate labor competition from people willing to work for even less. When wages are already as dismal as they are, is it any wonder the labor force has shrunken because people would just as soon take their social security early as keep up the desperate battle for a shrinking piece of the pie?

American workers finally have the power to negotiate against board members and share holders for a much bigger piece of the pie, and they are starting to do that in force. So, what do the rich do? As I’ve said we would see, they start rolling out their arguments in the media they control that we desperately need to increase immigration to get more workers.

No, what we desperately need to do is significantly raise labor’s wages and dial back CEO pay and shareholder earnings to make that possible in order to start attracting more people back to the labor force. Nothing speaks louder than real incentive. And that is starting to happen by market forces driven by a rage behind it all if we don’t allow migrant peasants to save the rich. (See: “The Rich Get Richer, and the Poor Keep Pouring over the Border to Serve Them.”)

The same article that reports how stagnant wages have been for those near the bottom for decades (due specifically to union-busting, greedy Wall-Street owners and mass-immigration suppressing wages and benefits) states that the top 1% have seen their real wages grow by 138%, but that number is low compared to most computations I’ve seen because this current article uses numbers from clear back in 2013! Their income has, in fact, grown by many times that amount as their stock values went to the moon after 2013.

That is why labor needs to fight hard to strip some of ongoing income away from these obese cats. As labor costs rise, we can expect greedy shareholders to do everything they can to preserve their exorbitant income by passing the costs on as inflation to the same people who are seeking and perhaps gaining the higher wages. However, if labor doesn’t fight, regardless, to wrench every penny they can from shareholders, the wealth of the 1% will rise by 1,000% per decade while the wealth of income will continue to shrink as wages lag behind real inflation.

The deeper truth is that a great deal of inflation is due to the greed of stockholders. They continue to believe they are entitled to 20% annual gains. Maintaining those earnings for shareholders does more to drive up costs than labor costs by themselves do. If consumers hold out all they can against inflation and workers strike all they can for better wages, maybe, just maybe, they might wrench a little blood of out those sugar beets that live at the top.

On top of that, of course, we give these corporate execs special discounts on their taxes on all those gains, which they already get to defer for years because the nature of the beast is, as it should be, that you don’t tax the gain until it is realized by sale of the asset. That said, there is certainly no reason they should have their source of income taxed at a lower rate than the middle class, but they’ve enjoyed that privilege since Reagan; and that certainly has not resulted, as promised back then, in a lot more factories being created in America, enlarging the demand for labor, and, thereby, “trickling down” to labor.

The word “trickle” was never emphasized hard enough in that bed-sore equation. While a Mississippi River in profits flooded into the pockets of the 1% across all of those years, the dripping faucet for the rest couldn’t even quench their thirst for survival.

That is obscene!

Some may find this hard to believe, but you can plainly see in the graph above that the only time the middle class saw a real growth in wages from the Reagan years to 2013 was during the Clinton years (1993-2001), which is also the only time in my own life when America ran a surplus budget, instead of a deficit. Oh, for the good times to return! (And I didn’t even like Clinton, but credit where credit is due.) Obviously running deficits to stimulate the economy has never helped the middle class out, but it has sure driven a ton of money to the extremely wealthy because most of the stimulus goes directly to banks and from there to stocks.

As of June, 61% of adults are living paycheck to paycheck…. Almost three-quarters, 72%, of Americans say they aren’t financially secure given their current financial standing, and more than a quarter said they will likely never be financially secure, according to a survey by Bankrate….

There are actually millions of people struggling,” said Ida Rademacher, vice president at the Aspen Institute. “It’s not something that people want to talk about, but if you were in a place where your financial security feels superprecarious, you’re not alone.”

Very little money trickles through the clenched fingers of the greedy. You have to fight for every penny you get.

Shop For Night Vision | See more…

Shop For Survival Gear | See more…

-

Sale!

Mesh Shooting Hunting Vest with Multi Pockets

Original price was: $59.99.$39.99Current price is: $39.99. Add to cart -

Sale!

Tactical Camo Nylon Body Armor Hunting Vest With Pouch

Original price was: $49.99.$39.99Current price is: $39.99. Select options This product has multiple variants. The options may be chosen on the product page