Originally published in The Daily Doom.

In this weekend’s “Deeper Dive” I laid out the facts and meaning of our first notable rise in unemployment. Today, I present for everyone a graph showing that, based on a recession indicator that has almost never failed to be SPOT ON, we are now entering a recession. Since we entered a recession (based on the normal GDP technical measures) throughout the first half of 2022, this will be the second drop into recession in a year, making this the double-dip recession I said a couple of years ago was most likely.

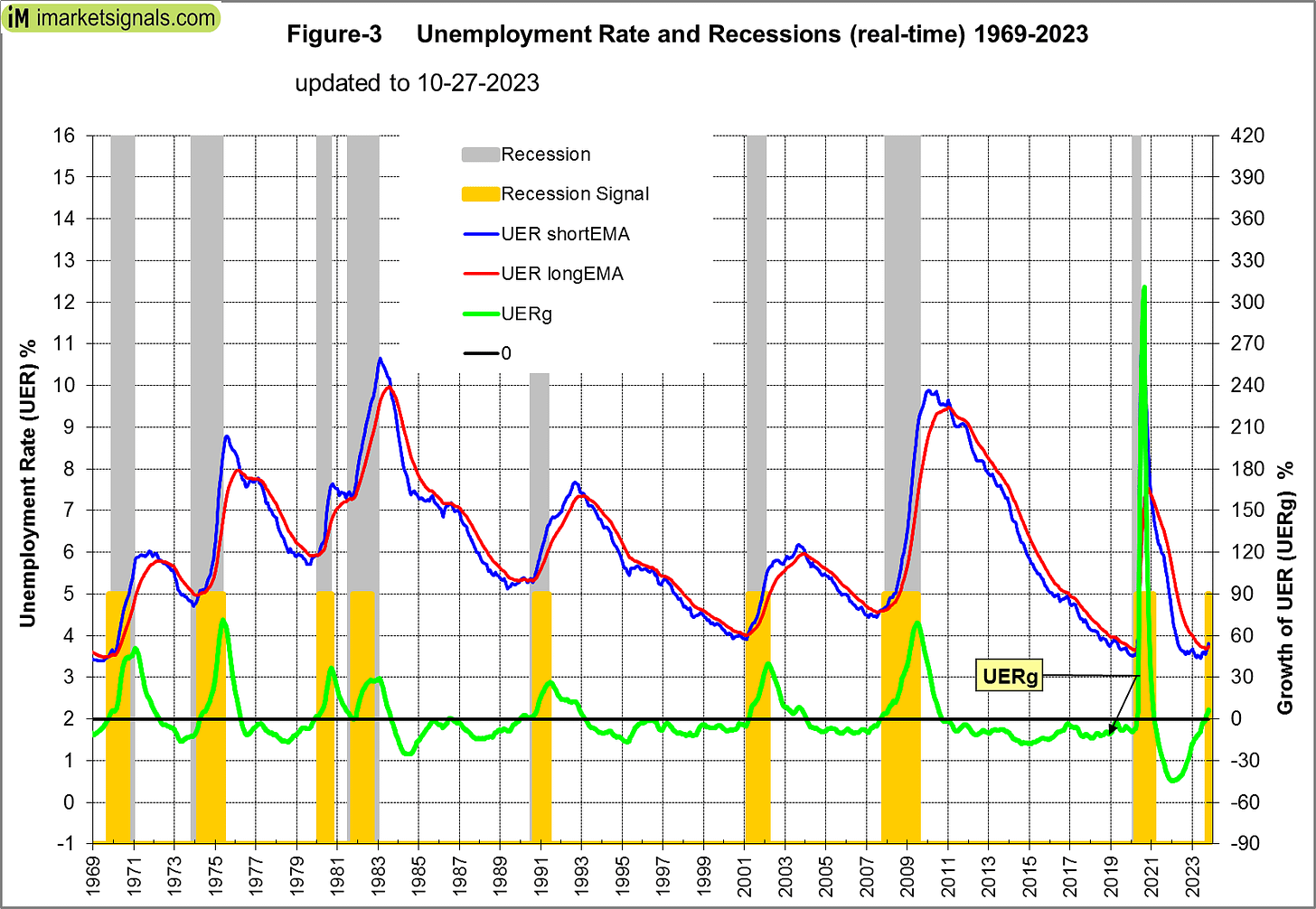

The following graph shows that every time the long-term (12 month) moving average of the unemployment rate moves up and the short-term (current unemployment rate) moves up and crosses over the long-term moving average, we are right at the start of a recession:

I’ve maintained for the past year that the lack of upturn in the unemployment rate was likely why the National Bureau of Economic Research (which officially declares recessions) did not declare a recession in 2022, even though the normal definition of a recession (two consecutive quarters of falling GDP) was met. Now unemployment has joined the picture, but GDP has moved back out of line, although, as I’ve reported, GDI (gross domestic income), which usually tells the same story as GDP, says GDP is lying because GDI has already moved negatively for two consecutive quarters like GDP did last year.

At any rate, the metrics graphed above have not been wrong in a VERY long time. The yellow bars show when the crossover metric happens and says a recession is beginning, while the gray bars, of course, show when the NBER eventually declared the recession to have begun. The green bar is a metric that has been highly accurate at indicating (by when it puts in its peak) when a recession has ended, which gets declared after the fact (just like the start of a recession) by the NBER. Its rise above the zero line also typically coincides with the start of a recession. So, we have three indicators all agreeing recession is HERE NOW.

One of my major predictions for this year, restated in January, was that we will slide back into recession for a second dip, which will be the worst “dip” of the two (more like a plunge):

I’ve said enough about the recession starting in 2022 for half a year where we saw what almost everyone called a “technical recession” that was not declared officially by the NBER that makes such calls, and I’ve said I expect us to go down into another dip this year…. We are taking a second and deeper dive into recession this year.

I’ve also maintained that unemployment was wrong to use as a recession gauge in 2022 because it was held up for all the wrong reasons (the huge decline in the available labor force, versus lack of economic demand for labor) due to unprecedented breakage in the labor force from the pandemic lockdowns. I explained that in my latest “Deeper Dive,” which also went over my January claim that inflation would likely rise again in 2023, in spite of the Fed’s fight, and showed how it now appears to be doing exactly that with the latest upticks. (See: “The Deeper Dive: The Nation is on Fire.”)

Now that unemployment has joined the party, I consider this the second dip of the same recession. We, of course, shall have to see whether or not GDP joins the party, too, and whether or not the NBER eventually agrees, but the world’s most reliable indicator of the start of a recession now agrees — recession has begun.

If GDP does not move into alignment, in that GDP is in a state of disagreement/denial with GDI that virtually never happens, will the NBER decide with GDI, which it does also look at? One of the two is grossly in error, I have already made the argument in a “Deeper Dive” a little over a month that GDP is the party that is wrong. (See: “The Deeper Dive into Deeper Recession.”)

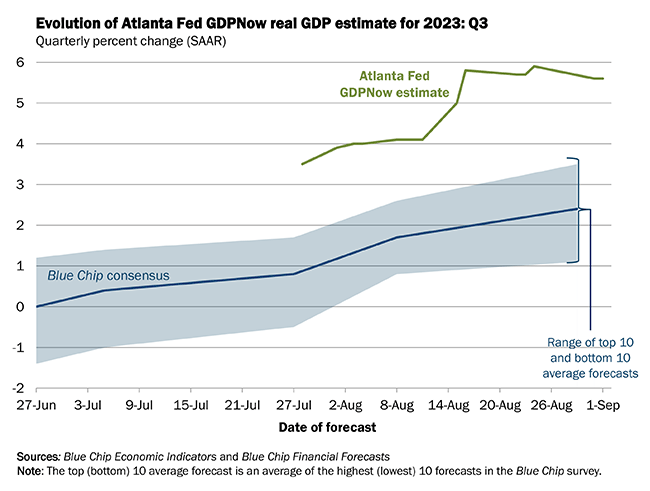

It is a truly anomalous situation to have GDP and GDI out of alignment at all, and right now they are extremely out of alignment, especially the Fed’s GDPNow estimate of where GDP will come in once reported. GDPNow shows screaming-hot GDP (all dealt with in those “Deeper Dives”):

GDPNow, I’ll note has never been particularly accurate. (I made a recent argument for GDPNow being in error here: ““The Deeper Dive: It Just Doesn’t Add Up.”)

These all agree: The upturn in the longterm unemployment average, the rise of the current unemployment rate above that average, two quarters of declining GDI, the LONG-standing yield-curve inversion that has been accurately predictive of recession for many decades, but especially the 10-year minus 3-month inversion, which burrowed deep at the start of 2023 and typically hits the zero line a few months to a year ahead of recession as a leading indicator:

That one has never been wrong. As Jeremy Grantham said at the start of this year:

The most ancient and effective predictor of future recession, the 10-year minus 3-month yield spread … is now clearly signaling recession within the next year. This spread has gone negative only 8 times in the past 50 years and all 8 times have been followed by recessions. To rub it in, there have been no other recessions. That is, every one of them was preceded by a negative reading. Not bad.

There is not a lot of that year left, and now …

All these indicators scream in unison, “Recession now!”

However, if you want the worst of it, read the boldfaced article below from Zero Hedge about the jobs downturn. As I was writing my own “Deeper Dive” this weekend about how the downturn in jobs has now aligned with my forecast for this summer, ZH assembled a weekend report that shows the recent jobs downturn is actually worse than anyone is stating because the positive number of new jobs added in August was almost entirely created by the Biden Admin’s seasonal adjustments and birth-death estimates, not actual jobs.

In fact, the “new jobs” number would have actually have gone negative if not for all the adjustments. (I’ve always said, “The devil is in the adjustments.” Especially with government reports.) The biggest reveal in ZH’s report, however, casts new light on all I’ve written recently about immigrants being used as a peasant labor force to combat wage gains being fought for by natural citizens of the US. The numbers are nothing short of astonishing, and natural citizens have been the big, BIG losers!