The old world is giving way to a new order. What key political-economic drivers of change are destined to shape our lives in the medium term?

According to an adage that is popular in the financial community, economists are sufficiently competent to correctly predict ten out of five recessions.

Despite this sobering statistic, I want to venture several conjectures regarding pivotal political-economic trends that will shape the world during the new “megacycle.” This upcoming secular (long-term) horizon may contain several business cycles and last at least 10-15 years. (The adjective “secular” is derived from Latin saeculum, meaning “generation”.) After embarking on an extensive and thorough fact-finding mission, I have selected and visualized five global and transformative supertrends, which are partly interconnected.

1. Supertrend: Liberal democracies under attack

The year 2024 exemplifies the trend towards the global expansion of the democratic system. More specifically, there will be a veritable flood of elections across the planet – with more than half of the world’s population going to the polls in over 70 countries.

However, the share of liberal democracies as measured by their share of the global gross domestic product (GDP) has declined significantly from 1992-2022 (see Figure 2), and this tendency is bound to continue.

Even within the self-styled free and democratic states, the acceptance of the democratic system is conspicuously decreasing due to the incompetence and misconduct of their governments. An increasing number of people also tend to doubt election results and make transfers of power more difficult than before. In the next step, those population segments do not recognize the elected representatives as legitimate.

A good example is the situation in the United States, where at least a third of the adult population believes that the 2020 presidential election was not legitimate. Such questioning of democracy neutralizes two of its few key advantages, that is (a) perceived legitimacy and (b) the smooth transfer of power.

Resistance to pseudo-liberal currents will continue to increase in the medium term.

Ever wider sections of the population will reject the quasi-dictatorship of minorities. One example is the fight against well-organized movements such as LGBT, which undermine the traditional family and thus eventually cause societies to falter.

The pendulum will also swing against so-called political correctness and woke-minded attitude cops who vehemently insist on a vigilant awareness of supposed societal injustices. More and more people will also turn against extreme climate protection measures, including totalitarian plans (such as the United Nations Sustainability Development Goals) to restrict meat consumption, clothing, mobility and energy usage, among other things. Eventually, capital markets will downgrade companies that engage in loss-making social and environmental activism and extremism.

Bearing in mind these inflective developments, I can surmise that politically incorrect organizations have great business potential. According to my vision, such entities will focus on performance rather than performance-undermining “inclusion” and other detrimental woke issues. They will hire, retain, and promote only top performers and serve the large, but disregarded segment of mentally healthy people with traditional values.

2. Supertrend: Fight against multiethnicity and multiculturality

According to the biblical story of Babel (Genesis 11:1-9) , all people were initially united and spoke one common language.

When people attempted to build the Tower of Babel, God punished them by confusing their tongues and dispersing them all over the Earth.

At least in the medium term, the dispersal and mixing of different ethnic groups, which has taken place since prehistoric times, will continue. This is because net migration, i.e., the difference between immigration and emigration, will remain at high levels in many places.

On the one hand, this applies to countries with an originally homogeneous population, like many countries in Europe. Overall, net migration in EU27 countries increased significantly from 2013-2021 , and this trend is likely to continue during the new megacycle.

In Germany, Europe’s largest economy, net migration has quadrupled since 2021, according to the federal government’s latest migration report. In 2022 alone, 2.7 million foreigners migrated to what was once known as the country of poets and thinkers.

On the other hand, immigration is also increasing in countries which are thought of as being ‘built by immigrants’ such as the USA. There, immigration rose significantly from 2021 to 2022 in particular (see Figure 4). Again, this historic trend is bound to continue, at least in the medium term.

Many Western governments are trying to sell a deceptive package to their voters regarding immigration. They use high-profile measures against asylum seekers – such as spectacular deportation stunts – as a cover to satisfy more nationalist people, while at the same time concealing the large number of economic migrants, which non-patriotic businesses expressly demand.

However, extreme measures such as the strong encouragement of mass immigration often yield their opposite, and pressure in one direction often creates counterpressure into the other direction. Because of this law, an increasing number of people will rebel against immigration, which leads to the intermingling of different racial and ethnic groups.

They will also fight against the concomitant multiculturalism, which fragments society and induces identity loss, and thus weakens all-important national unity, which is a key source of collective strength.

3. Supertrend: Increase in global debt

We are also witnessing a pernicious secular trend of increasing global debt. More specifically, global public debt as a percentage of GDP has risen sharply from 1999 to 2023 (see Figure 5). This trend is likely to continue during the next megacycle, leading to highly significant problems in the medium term.

In election years, governments habitually increase debt-financed spending in order to increase their chances of reelection. If populist governments come to power in 2024 and try to satisfy their clientele with higher, unfunded spending, the debt trend will continue to accelerate.

Debt is a convenient but unethical way to pass financial problems on to future generations. An increase in debt drives up long-term interest rates. Increased borrowing costs crowd out investments and thus, all other things being equal, lead to lower growth. In addition, burdened with high debt, governments must use an increasingly larger part of the national budget to cover interest payments.

Moreover, when you fall into a debt trap (a cycle of spiraling borrowing where financial obligations are met by taking on more debt), the prospects of fully repaying all debt also decrease dramatically. Furthermore, as debt and interest rates rise, a negative reaction from the financial markets is to be expected, as seen already in warnings from investors about “unmoored” public debt levels (see Figure 6).

The increase in national debt is particularly dramatic in the USA, where nominal US Treasury net bond issuance has risen sharply from 2015 to 2023 (with some improvements in between), and is forecast to increase further (see Figure 7).

According to an IMF forecast, interest payments in the USA will grow from less than 3% of GDP in 2022 to 4.5% in 2028. The increasing debt level will not only have negative consequences for the superpower itself, it will also destabilize the entire world. This is because other countries are bound to follow the bad example of the USA, which usually positions itself as the leader of the world; poor states in particular are likely to fall into debt traps.

4. Supertrend: Emergence of a multi-centric world

The world’s political, economic, and cultural center of gravity will increasingly shift to the east. After the end of the Cold War, the USA maintained a dominant, exclusive, and privileged position as the only remaining superpower in the world. However, the secular trend of the emergence of new global centers of power and thus the formation of a multi-centric world order has been accelerating, especially since the start of Russia’s special military operation in Ukraine in 2022.

By way of excursus, I would like to stress that I am consciously using the adjective “multicentric” instead of the more familiar term “multipolar.”

“Polar” comes from the ancient Greek word pólos (πόλος), a noun denoting an axis or the two vertices of an axis. On the one hand, if the prefix “multi” is used to denote a quantity greater than two, the term “multipolar” is an oxymoron. On the other hand, if the adjective “multipolar” entails just two centers (in this case, though, the right term would be “bipolar”), the qualifier is factually incorrect, because in the new emerging world more than just two centers of power are emerging.

The expansion of the intergovernmental organization BRICS – consisting of Brazil, Russia, India, China, and South Africa – in 2023 was an important early indicator of the accelerating trend towards a multicentric world.

In contrast to the US-centered dominance model, BRICS relies on the voluntary cooperation of independent nation-states. Thus, international cooperation in this association, unlike for example, in the European Union, is not bought at the expense of national sovereignty. However, due to this nation-centered principle, the level of unity and effectiveness of BRICS will not reach the performance of more integrated supranational bodies.

Russia, in particular, will become a new powerhouse in what I call a “Pan-Asian growth triangle.” An important reason for this development is this: The idiosyncratic country at the crossroads between East and West has so far shown the world that the Western sanctions regime can be broken and national autonomy – especially in spiritual terms – is possible. The courageous decision and proven ability of the Russian government to offer an attractive and functioning countermodel to Western liberal democracy matter tremendously in this context.

The renewed emphasis on traditional values is a poignant case in point exemplifying the determined anti-mainstream course of Russia. For example, in November 2023, the judges of the Supreme Court of Russia mustered the courage to classify the pernicious LGBT movement, which, among other things, promotes same-sex unions, as an extremist organization.

Given that a powerful state like Russia is taking a stand against an inappropriate interpretation of the concept of freedom, opinion leaders in other countries, too, are increasingly being encouraged to resist tendencies that they perceive as immoral excesses.

With the emergence of a new multicentric world order, the dollar’s dominant position as the world reserve currency will also be increasingly undermined. However, in my opinion, this secular trend will occur at a slower pace than many analysts expect. This is partly due to the exceedingly important global significance of the US capital markets.

5. Supertrend: Slowing of China’s rise

Since the beginning of the reform and opening policy in 1978, China has risen from being a developing country to the position of second-largest economic power in the world, and has become a state with gigantic military potential.

However, China’s catch-up performance vis-à-vis other strategic competitors is bound to slow down at least in the near future. One indicator of this trend is the fact that China’s GDP as a percentage of US GDP has actually decreased in nominal terms from 76% in 2021 to 66% in 2023 (see Figure 8).

China’s problems are due to a mixture of potent external and internal factors. On the one hand, the USA and Europe are trying to reduce their dependence on a country that they are classifying as an opponent. For example, in the wake of the USA’s decoupling strategy, China’s share of US imports of industrial goods decreased significantly from 2018-2022. During the same period, US imports from other Asian countries and entities, such as Vietnam, India and Thailand, increased significantly.

On the other hand, overall demand in China itself is weakening, and various structural problems are worsening on the supply side. Stock markets in China are reflecting the problems of the Chinese economy. For example, as of January 10, 2024, the Shenzhen Composite Index had fallen by 12.3% compared to the closing value on December 30, 2022. In contrast, over the same period of roughly one year, the S&P 500 Index in the USA grew by 24.6% and the NASDAQ Composite Index rose by as much as 43%.

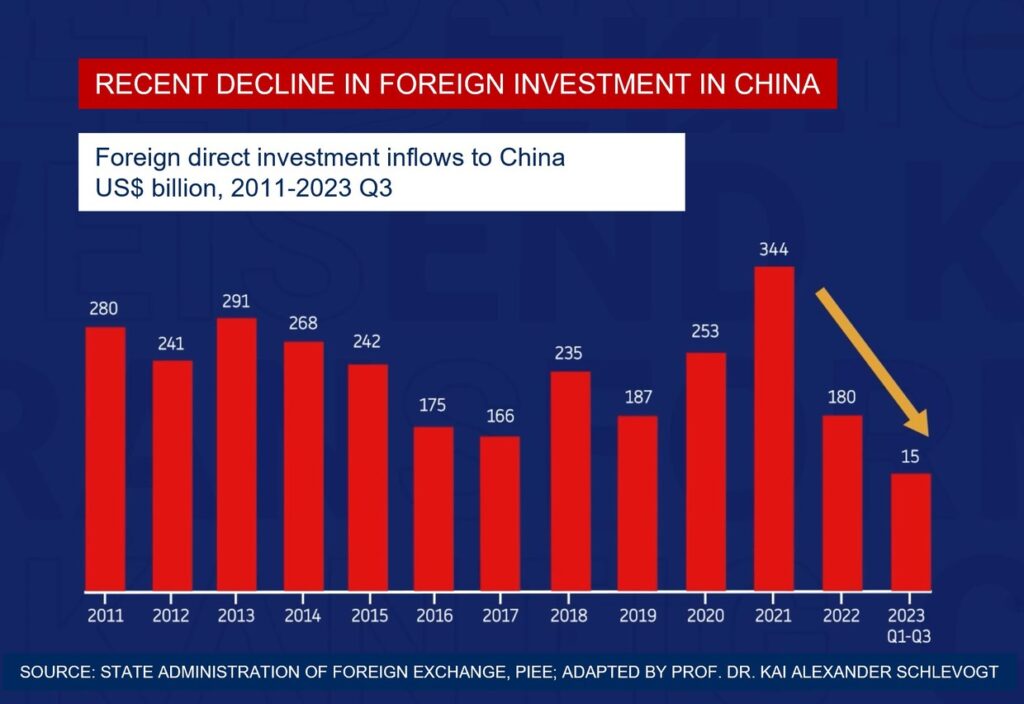

As a result of the Middle Kingdom’s declining perceived attractiveness, foreign direct investment into China – once a key indicator of China’s economic success – has declined from 2021 to the third quarter of 2023 (see Figure 9), and is forecasted to decrease further. At the same time, investment flows are shifting from China to other regions, such as the Middle East.

Despite the short-term slowdown in China’s rise, in the long term, I still expect the country to play an extremely important role in the world. This prediction is based on the Middle Kingdom’s enormous potential, which will ultimately be leveraged again, partly through what I call the “Art of Chinese Management” practiced in the private sector on the mainland. Therefore, China should not be written off!

In conclusion, the global supertrends outlined above will transform the world during the new megacycle. It is up to visionary, smart, and charismatic leaders to exploit these pivotal secular trends and, together with other like-minded movers and shakers, to build a bright new future that contrasts with today’s decline and decadence in many places, especially in the so-called collective West.

Shop For Night Vision | See more…

Shop For Survival Gear | See more…

-

Sale!

Stainless Steel Survival Climbing Claw Carabiner Multitool Folding Grappling Hook

Original price was: $19.99.$9.99Current price is: $9.99. Add to cart -

Sale!

Tactical Camo Nylon Body Armor Hunting Vest With Pouch

Original price was: $49.99.$39.99Current price is: $39.99. Select options This product has multiple variants. The options may be chosen on the product page

Reaction & Commentary

Reaction & Commentary