However in the last couple of weeks or so there have been a number of headlines suggesting that Dollar’s dominance is coming under threat from the Yuan so analysts and politicians on both sides of the aisle have started pressing that this could be the beginning of the end

For the dollar as the world’s Reserve currency and potentially the end for the US’s Financial hegemony more generally so in this video we’re going to explain what a reserve currency is why some people are so worried that the dollar is on the way out and whether the Yuan

Could actually replace the dollar as the world’s Reserve currency hint the answer is almost definitely no thank you so let’s start with a brief explanation of what a global Reserve currency actually is a global Reserve currency is essentially any currency that’s traded and accepted across the world now because these currencies are

Particularly safe in that they can reliably be used to buy other things States and Banks tend to hold significant amounts of these currencies in their reserves hence the name Reserve currency and since the end of World War II the US dollar has been the world’s Reserve currency as such today about

Half of all International transactions including the majority of oil purchases are nominated in dollars and most people borrow money in dollars too unsurprisingly this means that dollars are accepted as a legitimate currency basically anywhere in the world which is why dollars account for the majority of reserves and why people only want

Dollars in times of crisis take the last couple of years as an example as turbulence swept through the global economy investors returned to the dollar in their droves pushing the dollar to a 20-year High anyway the dollar status as a reserve currency bestows the US with what the french Minister of Finance once

Described as an exorbitant privilege essentially because there’s always a demand for dollars the U.S has more purchasing power than other countries and the US government can borrow more money than other countries and the US can also use the Dollar’s dominance and America’s dominance over the Global Financial system more generally to

Effectively sanction its enemies as it did when they expelled Russia out of the Swift inter-bank messaging system now this dominance and this power is something that both Russia and China have complained about in the past after its financial crisis in the 90s which forced many Russians to use the dollar

Instead of the the ruble the Russian Parliament banned public officials from using dollars as a unit of account and Dmitry Medvedev actually proposed a so-called super currency to replace the dollar in 2009 and when it comes to China just a couple of months ago the Chinese foreign Ministry published The

Perils of American hegemony which complained that the dollar is the main source of instability and uncertainty in the world economy and argued that the US uses the Dollar’s status as the world’s Reserve currency to coerce other countries into serving America’s political and economic strategy anyway with the two sides agreed just last week

Russia and China finally decided to do something about it with Putin pledging to adopt the U.N as the currency of account for payments between Russia and countries in Asia Africa and Latin America in a bid to displace the dollar at the same time they’re a slew of other

Headlines about Brazil France and Saudi Arabia also moving away from the dollar now this sparked some major anxiety in America for instance Fox News ran a panicked piece talking about how if the U.S lost its status as the world’s Reserve currency that would mean a complete implosion of the American

Economy by my Republic kind of inflation and America losing its superpower status Fareed zakira made a similar claim too warning CNN viewers that the U.S wouldn’t be able to afford its deficits if the U.S dollar lost its status as the world’s Reserve currency so is this

Really the end for the dollar and the US’s power financially and politically well no not really for starters China and Russia made similar announcements in both 2009 and 2013 and not much happened in either instance plus the claim that Brazil ditched the dollar isn’t even really all that true all that happened

Is that One Bank in Brazil agreed to join China’s new intra Bank payment system which is why its announcement only made the eighth bullet point in a minor government press release and this Brazilian bank also tried to do the same thing in 2009 and 2013 to no effect secondly while multiple minor news

Outlets have reported that France is buying LNG in Yuan they all cite the same writer’s report and we couldn’t even find the original report anyway thirdly the Wall Street Journal article only claims that the Saudis are considering switching to the Yuan but nothing has actually happened yet it’s

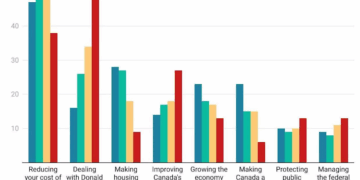

Also worth saying that these headlines reoccur every few years this one is from 2004 this is from 2007. this is from 2011 this is from 2018 and we even found this one from 1975 and every time these predictions ended up being wrong now while it is true that the Dollar’s proportion of

Global reserves has sunk from 72 in 1999 to 59 today this is largely because developing countries no longer Peg their currencies to the dollar but the dollar is still by Far and Away the world’s most popular currency it’s also used for the majority of international trade everywhere in the world apart from

Europe which uses the Euro for obvious reasons for context the Yuan accounts for about three percent of global Reserve portfolios and just two percent of international trade is denominated in the Yuan and that actually overstates things as well because 1.5 percent of that two percent is between Hong Kong

And mainland China so if if you exclude that then the new one actually does less International Trade than the Mexican peso or the Polish zloty now that doesn’t mean that this will always be true the Yuan May well become more popular in the future as we said Russia

Is now agreeing to use it and the pboc is trying to increase the yuan’s usage by extending swap lines to other central banks in Southeast Asia these Trends might also be accelerated by continued chaos in the U.S banking system or possibly even the introduction of a digital you want but fundamentally the

Yuan just can’t replace the dollar because that would require the pboc to allow people to freely trade the Yuan now currently the pboc doesn’t let this happen because they like to control the value of the one and that’s because generally China likes their currency to be undervalued because they’re an

Export-based economy and as such an undervalued currency makes the their exports more competitive as such if the pboc want to maintain this control the Yuan just can’t become the global Reserve currency because currently countries aren’t able to easily purchase and sell it to be honest this is one of

The big reasons why the pound became the world’s Reserve currency before the war and the dollar became the world’s Reserve currency after it on top of that being the world’s Reserve currency usually makes your currency overvalued which would involve a complete restructuring of China’s economy all in

All then while there are clearly some threats to the dollar and the US economy more generally it doesn’t seem likely that the Chinese Yuan or any other currency is about to overtake the Dollar’s Supremacy ultimately though we’ll have to keep an eye on this story and see if there are any trends that

Change this over the next weeks days and even minutes but while we’re waiting it only takes a few minutes every day to massively improve your skills and Safeguard your career against artificial intelligence that’s by investing in your own human intelligence and that’s where brilliant.org comes in brilliant.org is

The best way to learn maths and computer science in a fun and interactive way brilliant has thousands of lessons from foundational and advanced maths to AI data science neural networks decision making and more with new lessons added monthly that logical decision making course is super interesting too using

Principles from maths and science to help you reach your own decisions and I’m not naming any names but perhaps some politicians ought to get a brilliant account anyway you can try everything that brilliant has to offer for free for a full 30 Days by clicking our Link in the

Description plus the first 200 tldr viewers to do that will get 20 off Brilliance annual premium subscription thanks for your support and thanks for watching tldr

Reaction & Commentary

Reaction & Commentary