The American economy seems to be on a tear. In February, it added 275,000 jobs, another unexpectedly high count even as unemployment inched up to 3.9 percent. Fourth-quarter 2023 GDP growth clocked in at 3.2 percent, after a 4.9 percent expansion in the third quarter. Also last month, the Dow Jones Average hit 39,000. The White House touts these developments as proof Bidenomics is working.

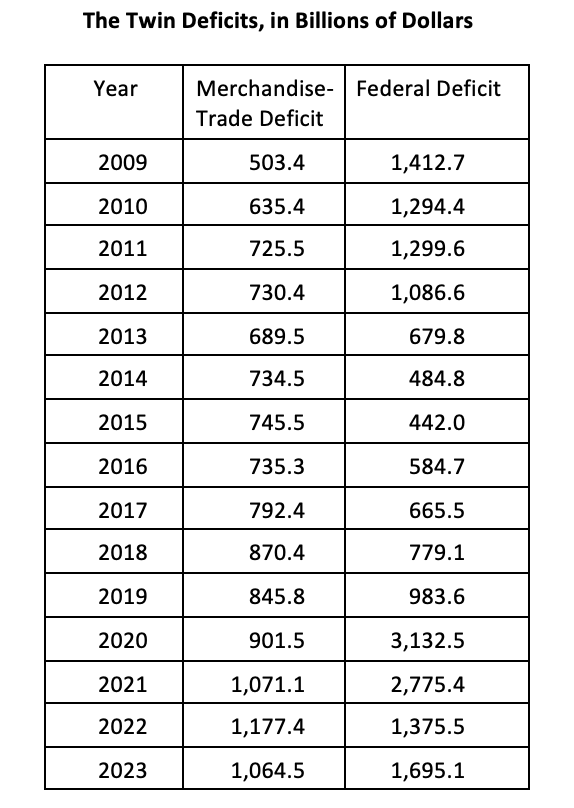

Nothing is really new here—the political class beams over upbeat economic indicators with some regularity. Previous administrations have done the same. But boasting about the latest data distracts Americans from the serious damage being caused by the “twin deficits”: the massive federal budget and merchandise trade shortfalls, each hitting trillion-dollar records in the last few years, per the chart below. These deficits used to be scrutinized and written about regularly but no longer in our spend-now, don’t-worry economy.

Federal expenditures of trillions of dollars that the country doesn’t have—the national debt has soared to an astonishing $34 trillion from $5 trillion in 2000—may create the impression of good times. But it’s an illusion. We are clearly living far beyond our means—and stealing growth from future generations while saddling them with repayment obligations. The unprecedented, and unsustainable, trajectory of the twin deficits threatens our superpower status, the dollar as the reserve currency, our living standards, and the viability of most federal programs, particularly the two most relied on by Americans: Social Security and Medicare.

More than a few Republicans seem eager to gore Social Security by reducing benefits and raising the retirement age; others are calling to “save” the program by allowing all workers to invest in the federal Thrift Savings Plan. Whatever their intention, these conservatives argue that Social Security benefits are unearned, too generous, and will soon bankrupt the system. But far more angst should be directed at the red ink that runs upstream from federal budget shortfalls: merchandise trade deficits.

Many economists mistakenly believe trade deficits don’t matter, free-trade theory holding that markets correct these imbalances. But the cumulative, in-goods deficit of $17.9 trillion since 2000 belies theory and cries for corrective action. Others deceptively cheer increased foreign investment in the United States. But each year we must sell assets—businesses, land, stocks, bonds, and Treasuries—to pay foreigners for their goods and to balance the national account. Foreign-capital inflows therefore don’t necessarily represent new money but are mostly a recycling of already-spent dollars.

Our parasitic relationship with China illustrates the problem. Because we allowed too much of our industrial prowess to be transferred to our adversary, we turbocharged China’s ability to out-produce and undersell us in home and world markets. With the resulting profit stream, Beijing became an enormous purchaser of Treasuries, lending us back the very dollars we sent overseas through our massive trade deficits—and in the process enabled Washington to both finance and supersize federal deficits.

Decades-long trade imbalances—not only with China but also with most of the world, including friends and allies—signal a fundamentally broken political economy: the governing policy consensus that should steer our economic ship to ensure U.S. wealth and strength. Because we have much less wealth-creating industrial capacity due to our trade profligacy, we have less money to pay for critical programs and balance the federal budget—or invest in infrastructure gamechangers and cutting-edge R&D projects, many defense-related, that historically have delivered American exceptionalism.

Our broken system also explains why stimulus plans or tax cuts don’t work as advertised, as much of the money leaves the country for foreign goods or foreign investment, boosting the economies of other countries rather than our own. Nothing therefore quantifies the hemorrhaging of American strength, wealth, and productivity quite like out-of-control trade deficits, particularly in high-value, advanced-technology products, everything from biotech to aerospace.

Subscribe Today

Get daily emails in your inbox

The real-life consequences have been devastating: the disappearance of factories and industries, the loss of millions of good-wage jobs for average Americans, the collapse of cities large and small—along with broken families, drug abuse, crime, shortened life spans, and a burgeoning welfare state. The twin deficits are proof positive of the epic failure of the American political class.

If current globalist policies are not reversed, our trajectory foreshadows an economic collapse of greater magnitude than the Great Depression. The Biden administration deserves credit for limiting critical-technology exports to our adversaries while trying to build-up onshore two important industries, semiconductors and electric-vehicle technologies (although its full-court press pushing consumers to buy EVs is misguided). And for its recent decision to invest billions in the domestic manufacturing of cargo cranes, a first in 30 years, to enhance port security. Trump likewise deserves kudos for calling for 10-percent tariffs on all imports, although the presumptive GOP nominee should roll his tariffs into a border-adjustable tax that would also inversely credit U.S. manufacturers for exports.

But more industry-specific programs are necessary. Only a combined all-of-government and all-of-industry campaign to re-industrialize and halt the trade (and thus budget) hemorrhaging is the way out of the current morass. Without an effort on the scale of our mobilization of industry to win World War II, we won’t have to worry about Social Security: It will inevitably implode along with the rest of the economy, and the American way of life.

Reaction & Commentary

Reaction & Commentary