The following article was originally published as one of my “Deeper Dives,” which only paid subscribers can read, though I made the introduction available to everyone for free. However, it seemed to me like it was a much more important article than most I’ve written, so I did something with that full article that I’ve never done with a Deeper Dive. I put a poll at the end and asked my paying subscribers if I should make the full article available for free to everyone. 76% answered that, yes, I should make it available to everyone for free because it is that important, even though they pay for the privileged content. 0% answered that they already knew what the article told them. (So, you didn’t likely hear about this shocking news in the mainstream media. If you did, it certainly got glossed over with no pointing out of the heinous truths involved.)

Even though only 140 paying subscribers could read the full article, the mere introduction that was available to everyone got more than twice the number of likes compared to any full article I’ve ever written on The Daily Doom. On top of that, the introduction alone got more shares than any article I’ve published on The Daily Doom during its first year as a subscriber-supported publication. In fact, the simple intro got about ten times the number of shares that the next leading full article got! That introductory piece also generated more free subscriptions by far than any full article I’ve written on The Daily Doom. So, with all of that, I’ve decided, yes, I have to share it with everyone for free.

Now, I had no intention of writing an “anniversary edition” of The Daily Doom when I asked my paying subscribers that question at the end of the full article, but seeing the level of interest my paid subscribers expressed for me to share the full original Deeper Dive for free, and THEN realizing that my launch of a subscriber-based publication on Substack happened on April 4th (which I actually hadn’t given a thought to), I decided, “Why not make republication of the full original article a special anniversary edition for everyone?” So, to make that meaningful, I’m also doing something I didn’t think I would do: I’m offering an anniversary sale for all current paying subscribers and all current free subscribers and everyone who has never subscribed of 20% off. It’s a celebration of a year of success, thanks to readers.

I’ll probably never do this again, and it may even cause my total revenue to go down as current paying subscribers jump back in for another full year at a lower price than they got the first time around! But, hey, it will be the only first-anniversary edition I ever get to do, so why not make it a party? Offering the sale is also a way to thank those who made The Daily Doom possible for the full past year. (And while all of this sounds like preplanned hype, I assure you—as someone who has shown himself to be a straight shooter in everything I write because unvarnished truth is what The Daily Doom is all about—that I had no thought of doing a sale when I asked my paying subscribers if I should make Monday’s original Deeper Dive available to everyone for free.)

April 4th also happens to be the day I first reconnected with my high-school sweetheart, which eventually resulted in our getting married. We plan to celebrate the day together anyway. So, what the heck! Here goes—a celebration party for everyone, meaning all caution to the wind as far as whether a sale results in lower revenue due to everyone resubscribing at the sale price who originally subscribed at the full price. (Of course, those of you who would like to resubscribe at the full price just to help me stay at this can wait until the next edition of The Daily Doom when the subscription box will be at the regular price ; ) And, just to make things clear for all current subscribers, entering a new subscription now does not result in your losing time already paid for on an annual subscription last year; the full new subscription year gets added to the end of the one you already paid for.)

With no further ado, the following section, now labelled “Introduction” is the part of the Deeper Dive that was available to everyone for free. I believe the full article is one of the most important and strangely unreported stories I’ve done. If you already read the first part when it came out on Monday, just skip down to the continuation of the article below the introduction to get EVERYTHING you missed … for free.

(And, just as I offered an introductory week to all content for free on April 4th last year, I’m making the anniversary sale price good for a week if you use the links in today’s edition … just in case you come across this late.)

Introduction to the original article:

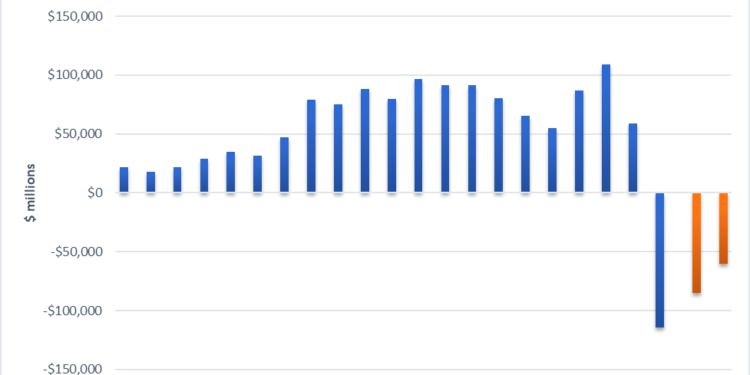

The Fed’s tightening regime just bit deeper into the national deficit. For the very first time in 108 years, the Fed just ran at a net loss, and it was huge. To be specific, the Fed reported a loss of $114.3-billion in 2023. Now, for the Fed, losses are no big deal because they own the money printers (at least the ones that just require entering digits in data fields on banking computer systems). However, for the US government, the loss is all theirs to shoulder.

The way this works is the Fed normally transfers all of its net profits to the US Treasury’s general account, and it had profits every year … until 2023. The Fed’s charter was set up so that IF the Fed EVER did experienced a loss, AS IT FINALLY HAS, that loss would be handled as a debit against future profits the Fed hands over to the government. So, no profits from 2023 go to the US Treasury this year, and future profits will have to add up to $114.3-billion before the Fed again starts handing any profits to the government. In the meantime, that means the government has to add that shortfall to its debt.

While the Fed cannot realize any losses, itself, you might think the first loss in its entire existence would have a somewhat bone-chilling effect, as many people would wonder what was so exceptional about 2023 that it is the only year to have seen a loss in the Federal Reserve System. No matter what the US went through—the Great Depression, World War II, the Great Recession, the Covid lockdowns with their massive deficits—there was never a loss until the year just accounted for.

Moreover, the Fed is predicted to have losses for 2024 and for next year as well:

What gives here? 108 years with no loss and with some of the biggest net profits ever from the Great Recession all the way to the present, and now, BAM! right to the bottom? Moreover, this plunge follows the biggest year of profits the Fed ever realized in its history just two years ago.

Yet, apparently, the mainstream financial media either failed to notice or didn’t think you’d even care to know what just went down here. (That, or their owners are friends of the Fed.)

The answers to “what gives here?” lie in the rest of the original Deeper Dive. So does the source of the Fed’s losses, which tax payers will find to be the real angering part when they see who their money all went to, but I thought everyone should, at least, know the Fed just scored the first loss in its history, and it is all yours to bear!

Please become one of those who share this special edition of The Daily Doom with everyone now that it is available to everyone for free:

[That simple bit was the introduction that proved so popular, but the real ringer on the Fed’s massive, first-in-its-history loss and how you get fleeced for it comes in finding out who actually gets all your money! The rest of the original Deeper Dive now appears below, and it lays out the whole ugly truth. The first thing to realize about this operating loss by the Fed is that it increases the national deficit by MORE THAN $114-billion! However, that is not the ugliest part:]The original Deeper Dive Continued:

… It increases it by the difference between the positive $58.8-billion that the Fed handed over to the Treasury the year before and the negative $114.3. That $58.8-billion kept the deficit in 2022 that much smaller. Now the deficit will be $58.8-billion larger, due the government’s loss of Fed revenue, and it will continue to be larger until the Fed recovers all of its $114.3 billion loss over time. However with more losses projected for this year and next, it may be a very long time before the Federal government starts seeing any profits handed over by the Fed. Throughout those years that run beyond the years of projected losses (i.e., when the Fed is recouping the losses) the government will run higher deficits. [And that’s still not the most important ugly truth.]

So, really, with such large losses projected to come and so many years for the Fed to recoup those losses, it means the tax payer will be paying the difference, or (more realistically of course) the tax payer will become liable for that much more in government debt. Funding that extra debt also likely means some small uptick in interest on the debt to create demand for more bonds and strain on the slowly dimming US credit rating. (It all counts and prices in somewhere, as there is no free lunch.)

Where does the Fed’s loss come from?

The biggest contributor to the Fed’s loss is “interest expenses,” and you’re going to love this one: The interest is the interest the Federal Reserve pays to banks. The ugliest truth here is that loss of profits from Fed operations to the US government that it serves was almost entirely to enrich banksters! (And, yet, some of them are still going bust.)

You see, when the nation’s banksters took all that FREE money the Fed was over-pumping into the economy and then loaned it back to the Fed in exchange for US Treasuries from the Fed’s holdings as collateral, the Fed promised the banks interest when it paid those reverse repo loans back because, with a RRP loan, it is the Fed that is taking out the loan (of its own money given to the banks). It does this in order to remove excess cash from the banking system (cash the Fed pumped into those banks in the first place), and it promises to pay a small sum of interest when it finally gives the banks back the free cash the Fed created for the banks in the first place, at which point it collects back its collateral Treasuries. The interest is a small amount like half a percent above what the banks would get on reserves, but when it’s half a percent on $2.7-TRILLION, which is where the RRP program peaked out a year ago, April 12th, that’s a lot o’ dough:

Now, you might reasonably ask, “Why would the Fed create free cash and give so much to banks and then ask them to loan the money back to the Fed and pay them interest to entice them to do so?” Well, a lot of people were asking this when the Fed was creating free money for banks like it was going out of style.

Why would the Fed create way more money than the banks could use to where their reserves were so sloshy that they wanted to get the money out of reserves? And why would the Fed do this when it could plainly see that its own continued money printing was fueling high inflation? After all, by the time we reached the summit in that graph, even the Fed had given up on the ruse that inflation was just “transitory.” Yet, it kept the money pump going and then offered the banks interest if they would loan that free money back to the Fed.

The only answer I could come up with to explain this extraoridinarily peculiar phenomenon was that the Fed was parking money to use later as clandestine quantitative easing to offset its quantitative tightening (QT) when that day came. You see, when the Fed was rapidly expanding this RRP loan program, I called it clandestine QT because the Fed was soaking up cash rapidly in huge amounts, even as it was creating cash. The only reason I could think of [for this clandestine QT], since I didn’t hear anyone in the mainstream financial media asking this obvious question of the Fed and certainly didn’t hear the Fed saying anything about it, was that that the Fed was banking this to become clandestine QE later on when its actual QT began.

Now we have seen that is exactly how this worked. As QT and interest rates started hitting banks hard, they started drawing their cash back and collecting the interest the Fed had promised them for extending these generous loans of the Fed’s own created money. This way, the banks just quietly draw the money back, and no one calls it QE.

However, what that means, is the taxpayer is now paying the banks the interest on those loans of excess free Fed money that the banks loaned back to the Fed since this comes off the top of Fed remittances to the US government … and we will be paying that for years to come because the Fed will no longer being paying the US government any money for years to come. Many of these RRPs weren’t even with US banks but were with foreign parties.

What an outrageous world!

Here is the Fed’s definition of RRPs:

Reverse repurchase agreements are transactions in which securities are sold to a set of counterparties under an agreement to buy them back from the same party on a specified date at the same price plus interest. Reverse repurchase agreements may be conducted with foreign official and international accounts as a service to the holders of these accounts. All other reverse repurchase agreements, including transactions with primary dealers and a set of eligible money market funds, are open market operations intended to manage the supply of reserve balances; reverse repurchase agreements absorb reserve balances from the banking system for the length of the agreement. As with repurchase agreements, the naming convention used here reflects the transaction from the counterparties’ perspective; the Federal Reserve receives cash in a reverse repurchase agreement and provides collateral to the counterparties.

Why?

You have to ask “Why would they do this?” because the question is begging to be asked: “Why would the Fed want to lay up this fund for later clandestine QE? The answer that I suggested when the Fed was issuing the RRPs was that the Fed knew its eventual QT during a time of rising interest would create stress on bank reserves (as we saw blow up at this exact time last year), so this way the Fed could backfill those reserves at each bank’s own control as to when the bank asks for its cash loan back, and it could give the banks more free money in the from of interest without calling any of it “quantitative easing” because doing QE in the middle of doing QT would make it look like the Fed wasn’t doing QT at all.

And, in fact, that is the effect.

HOWEVER, all of that banked reserve cash is running low now to where fewer and fewer banks have any left to draw from, which means QT will now finally start to get real, instead of pretend.

The next obvious question is why would the Fed want to do pretend QT, meaning pretending that it is taking down bank reserves, even as it is letting trillions flow back into bank reserves? And the only answer I could think of for taking money out the front door (via QT) while giving armloads of it back by returning these loans was to create a safeguard they felt they needed because the last time they did QT they practically blew up the banking system!

This way banks … would naturally keep the loans to the Fed out, making interest so long as they had plenty of cash, and then start calling them back as cash tightened up, collecting the interest owed along with the principle lent.

Here’s how the Fed practically blew up the banking system in 2019: The daily “overnight” loans that banks give to each other at extremely low interest to balance their accounts each day (called “repurchase agreement” loans or “repos” for short) suddenly exploded through the roof in interest back in the fall of 2019 because bank reserves suddenly became too tight due to all the QT the Fed had been running. Banks stopped lending to each other almost all at once, which would quickly cause the financial system to lock up. The Fed had to pump lots of new QE in, claiming all the while that it was not QE, to end the problem.

This time around, the Fed hoped the reverse repo loans would create a huge buffer—an available pressure relief—and they have … so far. That means it is only now that we are getting near the end of the banked surplus of REVERSE repos (RRPs) with the Fed from the QE period that QT will now start to put us at risk of yet another repo crisis, as I mentioned in my predictions for later this year. Reserves will finally start to tighten up, as they did in 2019, which is why the Fed is now also talking about cutting its QT rate in half. However, cutting it in half only means cutting it back to exactly the same rate it was running in 2019 when it blew up the safest, most boring loans in the banking world.

So, that reduction in the rate of doing QT, too, is an odd level of reassurance, and you have to ask if the Fed knows what it is doing any better this time than it did last time because CLEARLY it did not know what it was doing last time. That was why I predicted in January of 2019 we’d likely see a major repo crisis in overnight bank loans in the latter part of that year. The main reason I make these predictions is to show that it is not as if the repo crisis couldn’t be seen coming. That means the Fed, being in a far better position to see it coming than I, is completely without excuse for not seeing it back in 2019.

That’s why I say now that slowing QT to the same pace they did in 2019 (as some voting FOMC members at the Fed are now talking about) is faint reassurance now that the RRP buffer is just about dry. (And for some banks it most likely is dry, as banks socked away various amounts of excess cash back when the fund was growing, and some probably didn’t sock any away, while all have been withdrawing it at different rates).

The important thing for this Deeper Dive, though, is to make sure you recognize that, as US taxpayer, you are the one paying for or backing the government debt for this insurance program for banks. The interest is coming from your government in the form of lost profits from the Fed FOR THE FIRST TIME IN US HISTORY!

Now, the RRP program is not the Fed’s only liability it pays interest on; however, it is the oddest one, and it is one of the biggest ones. It is one that is totally unique to the present period as you can see in the graph above. Yes, there have been some of these RRP loan agreements made in earlier decades, but you can see they were always absolutely minuscule until they first started to rise ahead of the Fed’s first QT period and then leaped skyward during the Fed’s enormous quantitative easing of 2022. Suddenly, all those loans looked like monkeys jumping around on a trampoline to where you have to ask, “What the heck is going on there?”

That was also the period of obscene excess that fueled the high inflation that we spent all of 2023 fighting. You, the taxpayer paid for 100% of that inflation, too. So, you have to ask, “Why did we want that? Why do more QE than the banks need when you can see it is creating high inflation?” It means you pay for the inflation, then you pay for the higher interest the Fed creates on all of your credit during the inflation fighting period (while you continue paying for the inflation), and then you pay for all the interest handed over to banks on their RRPs that help buffer their problems as you become liable for the government’s increased debt.

And, yet, no one ever fires the Fed. No considerable number of citizens ever asks for the Fed to be seriously held to task for all these pains you suffer; and, most of all, no considerable contingent ever even demands the Fed to be reformed. (As chronicled in my little book assembled from my writings about the Great Financial Crisis: DOWNTIME: Why We Fail to Recover from Rinse and Repeat Recession Cycles.)

They don’t just get you coming and going, but in the middle, too!

Moreover, funding these “deferred assets” as the Fed strangely likes to call them is, itself, inflationary over the long term because these RRPs, as they reverse, put more cash into the system, slowing the rate at which inflation comes down under QT. When the cash was parked at the Fed, it was kept out of circulation so had no inflationary effect. It’s effect now is to slow the progress on fighting inflation.

You might wonder, why go through all this nonsense? Why not just create a lot less of a cash slush fund by doing less QE and avoid creating inflation in the first place so you can do less QT down the road? Indeed, you might ask, and you would do well to do so.

I don’t have an answer. It’s such an obvious question, you can only scratch your head as to what these lunatics are up to. In a normal world, they’d be fired … or imprisoned … because their negligent financial planning circus is costing you a fortune! (While making them one, as I’ve never seen anything but a rich central bankster. Why do you think Papa Powell smiles so gently as he tells you all he is doing for you?)

Just the extra interest expense this loss places on the federal government at today’s rates is equal to the ENTIRE operating budget of the Federal Reserve, including all of its employees (even Papa Powell) pension costs, real-estate costs, etc.

Current projections show that the Fed’s net operating losses will finally be recouped from the funds that it normally would have remitted to the Treasury (lowering your taxes or your share of the national debt) sometime just before the next decade.

Yet, Powell stands there after each FOMC meeting and looks and sounds so normal as he tells you all the Fed is humbly doing to try to manage your national currency for you in order to achieve its mandates of providing a “stabile currency” and to protect you from extreme business cycles. But, in that case, why is it that we have in the last two decades had three of the most extreme business cycles we’ve ever seen? Again, you would do right to ask.

Good job, Fed. But this is why they get the big bucks (and get to “print” the big bucks with mere computer keyboard clicks).

There has finally been some small outcry against the Fed for its gross financial and economic mismanagement:

In July 2023 Senator Rick Scott of Florida wrote an editorial railing on Fed Chairman Jay Powell for his lack of accountability for growing the Fed’s Balance Sheet to $8.3 trillion and losing $1 trillion of taxpayer’s money. The recently reported -$114.3 billion operating loss will only add further scrutiny to the Fed.

However, the small outcry has gone nowhere. More outcry is needed.

Originally published at The Daily Doom.

Shop For Night Vision | See more…

Shop For Survival Gear | See more…

-

Sale!

Portable Mini Water Filter Straw Survival Water Purifier

Original price was: $29.99.$14.99Current price is: $14.99. Add to cart -

Sale!

Quick Slow Release Paramedic Survival Emergency Tourniquet Buckle

Original price was: $14.99.$7.99Current price is: $7.99. Add to cart -

Sale!

Stainless Steel Survival Climbing Claw Carabiner Multitool Folding Grappling Hook

Original price was: $19.99.$9.99Current price is: $9.99. Add to cart

Reaction & Commentary

Reaction & Commentary